CalPERS

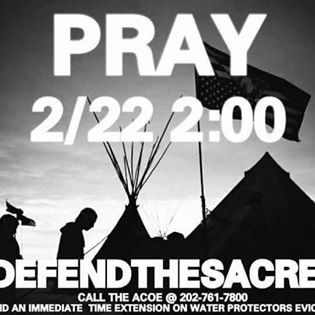

Pray for the Water Protectors!

Eviction being served later today.

SACRAMENTO, CA – The California Public Employees’ Retirement System (CalPERS) today announced it has joined over 100 fellow investors asking major U.S. and international banks backing the Dakota Access Pipeline to address the concerns of the Standing Rock Sioux Tribe.

The investors, which include four New York City pension funds, Boston Common Asset Management, Calvert, and Storebrand Asset Management, called on the banks to act “to protect the banks’ reputation, consumer base, and avoid legal liabilities.”

“Banks with financial ties to the Dakota Access Pipeline may be implicated in these controversies and may face long-term brand and reputational damage resulting from consumer boycotts and possible legal liability,” said the investors in a statement. “We call on the banks to address or support the tribe’s request for a reroute and utilize their influence as a project lender to reach a peaceful solution that is acceptable to all parties, including the tribe.”

The statement was directed to 17 banks, including Bank of Tokyo-Mitsubishi UFJ, Bayerische Landesbank, BancoBilbao Vizcaya Argentaria, BNP Paribas, Citibank, Crédit Agricole, DNB, Industrial and Commercial Bank of China, ING, Intesa Sanpaolo, Mizuho Bank, Natixis, Société Générale, Sumitomo Mitsui Banking Corp., SunTrust Bank, Toronto-Dominion Bank, and Wells Fargo.

CalPERS has about $6.5 billion invested in 16 of the 17 banks as a shareholder and creditor, as of Dec. 31, 2016.

CalPERS’ Investment Beliefs (PDF) and Global Governance Principles (PDF) both call out the importance of corporate responsibility on environmental and community matters, and both clearly state that engaging with companies is one of the most effective ways to address major issues.

“We are pleased to join our fellow investors to help address the community concerns and environmental risks that can impact the long-term returns of our investments,” said Anne Simpson, CalPERS’ investment director, sustainability. “We believe that engaging with the companies we own is the first course of action to effect change and a preferred option over divestment where we lose our voice as an investor.”

For more than eight decades, CalPERS has built retirement and health security for state, school, and public agency members who invest their lifework in public service. Our pension fund serves more than 1.8 million members in the CalPERS retirement system and administers benefits for more than 1.4 million members and their families in our health program, making us the largest defined-benefit public pension in the U.S. CalPERS’ total fund market value currently stands at approximately $311 billion. For more information, visit www.calpers.ca.gov.